The world is currently experiencing digital revolution. There is no doubt that digital assets are here to stay and global leaders and banks are exploring blockchain solutions. The legacy financial system is in dire need of an overhaul. One that increases speed, efficiency, and interoperability. Below we will dive into the current development of Central Bank Digital Currencies and how Quant’s Overledger technology is an integral component for the roll out of the new financial system.

Central Bank Digital Currencies— when, not if

Central Bank Digital Currency activity increased significantly in 2021 in an effort to create the next evolution of money — Cash 2.0. Central banks from countries that represent over 90% of global GDP are reported to be exploring CBDCs.

Three of the world’s major currencies — the dollar, euro and renminbi — are actively moving to the introduction of a CBDC. China’s e-Renminbi is in the lead with a potential 2022 launch during the Beijing Winter Olympics.

G7 Agreement on Digital Currencies

Finance ministers of the G7 countries have reached an agreed position on 13 public policy principles for central bank digital currencies (CBDCs), in a move that could pave the way for greater adoption of CBDCs across the world’s leading economies.

The Bank of International Settlements published a report on CBDCs. The report describes how CBDC projects and pilots have been underway since 2014 but efforts have recently shifted into high gear.

“Demands on retail payments are changing, with fewer cash transactions and a shift towards digital payments, in particular since the start of the Covid-19 pandemic.”

“Central banks around the world are working to safeguard public trust in money and payments during this period of upheaval. To shape the payment system of the future, they are fully engaged in the development of retail and wholesale CBDCs, alongside other innovations to enhance conventional payment systems. The aim of all these efforts is to foster innovation that serves the public interest.”

PayPal could be to CBDCs what private banks are to physical dollars.

The company’s CEO, Dan Schulman, laid out a vision during its investor day for PayPal’s digital wallets being the means by which central banks distributed CBDCs to consumers.

“You think about how many digital wallets we’re going to have in the next two, three or five years, and we’re a perfect complement to central banks and governments to distribute those digitized forms of currency,”

We are working with regulatory agencies, central banks across the world. The number of countries that are looking at CBDCs, central bank issued digital currencies is increasing rapidly. You’re like at 40 countries six months to a year ago. You’re almost up to 100 countries looking at it right now.

And clearly there is an opportunity to think about a new infrastructure that is more efficient, that could be a lower cost, do transactions and also get money to people much faster than happens today. I mean, the other day, I sent an EFT from one bank to another bank, and that bank told me it would take three days to access that money in the EFT I sent. That’s crazy. It needs to be instantaneous.

-Dan Schulman, CEO Paypal

Visa has already built and launched its solution to settle USDC (US Dollar Coin) transactions on Visa cards on the Ethereum blockchain. Its pilot allowed Crypto.com to settle a portion of its obligations for the Crypto.com Visa card program in USDC. This was enabled by Anchorage, the first federally chartered digital asset bank and an exclusive Visa digital currency settlement partner. These exact capabilities and their treasury improvements and integration with Anchorage will help with CBDC processing in the future.

Financial services company, Visa, has suggested that central bank digital currencies (CBDC) and stablecoins should be interoperable, according to a published paper. The “Universal Payment Channels” whitepaper discussed an interoperability platform for digital currencies and a framework built on top of various distributed ledger technologies (DLTs).

Visa Unveils Universal Payment Channel for Blockchain

Visa is working on a universal payment channel project that connects blockchain networks to a variety of cryptocurrencies, stablecoins and central bank digital currencies (CBDCs).

As the company announced on 9/30/21, the payments giant’s research and product teams are working on a universal payment channel (UPC) initiative, which is a blockchain interoperability hub that connects blockchain networks and allows for transfers of digital assets.

“Imagine splitting the check with your friends, when everyone at the table is using a different type of money — some using CBDC like Sweden’s eKrona, and others preferring a private stablecoin like USDC,” Visa said in its announcement. The company added that this type of tool “may well be a reality” in the “not-too-distant future” with the UPC project.

Blockchain Interoperability — Quant’s Solution

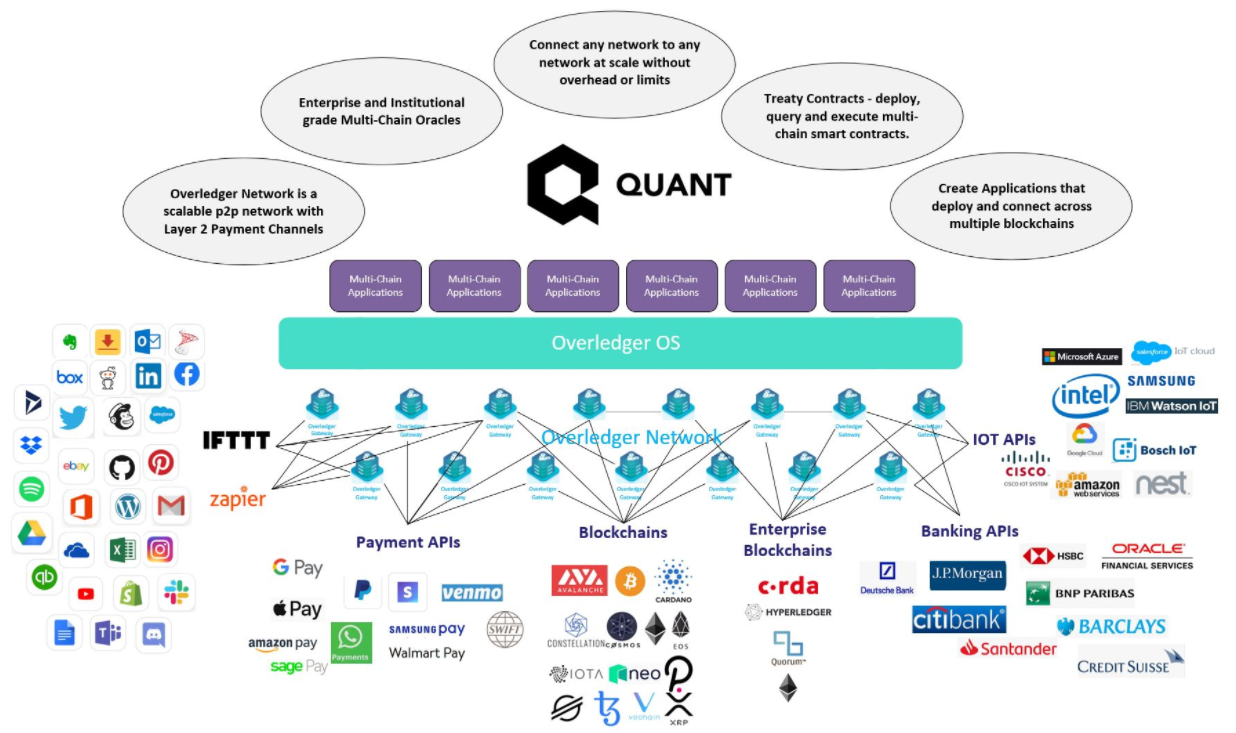

What is the technology which can make this possible? Quant’s Overledger

Overledger OS is an interoperable blockchain operating system. In other words, it allows those using the Overledger OS to interact with multiple blockchains simultaneously. The Overledger OS is intended to be the Windows or macOS of the future network of blockchains, running on top of other blockchains to provide scalable Any-to-Any interoperability.

Overledger allows existing blockchain and legacy systems to connect without having to manipulate its existing infrastructure. Only requiring 3 lines of code and a secure API that is fully regulatory compliant.

In 2020, CEO Gilbert Verdian, announced that Quant will collaborate with the Massachusetts Institute of Technology and Intel to create an open blockchain agnostic protocol.

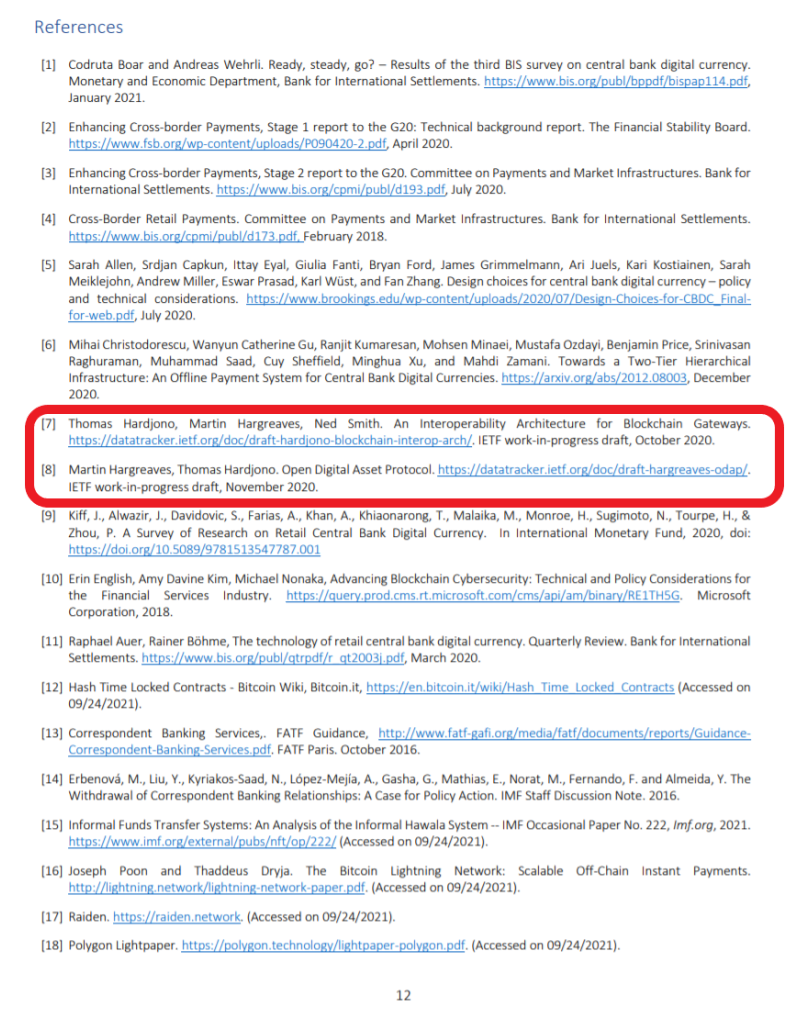

The protocol was published with the International Engineering Task Force (IETF) for the Open Digital Asset Protocol (ODAP).

IETF is a body that defines standard Internet operating protocols such as the TCP/IP protocol.

Visa’s white paper on Universal Payment Channels sites the IETF proposal and the Open Digital Asset Protocol.

In a tweet, CEO of Quant, Gilbert Verdian said,

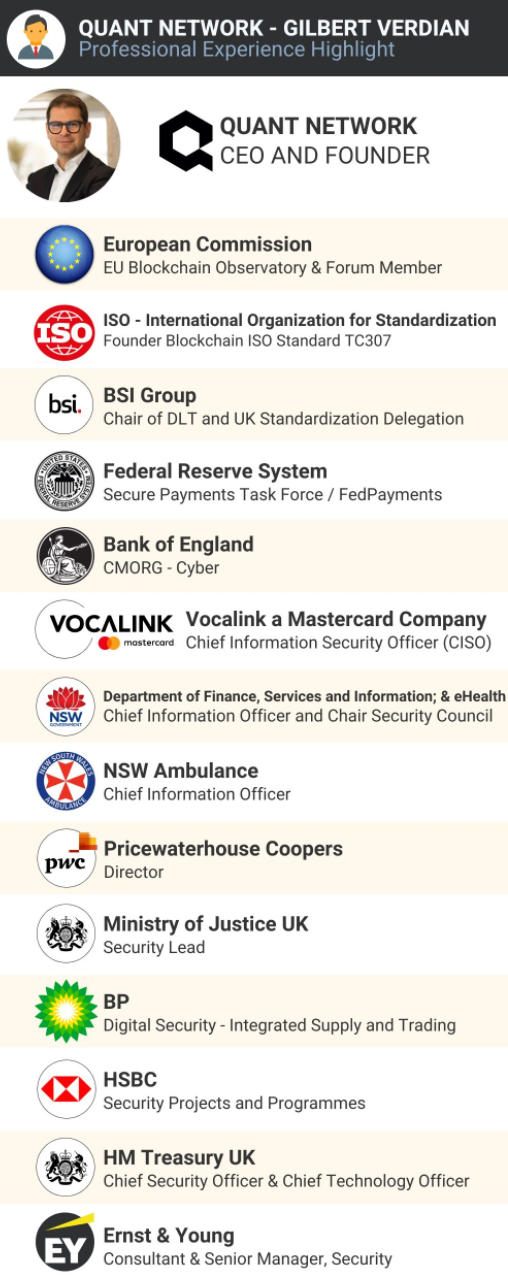

Who is Gilbert Verdian?

Having over 20 years of industry experience, Gilbert is a man on the cutting edge of technology; working at the intersection of business, technology and security. By blending his technical expertise and business know-how, he is able to transform and solve complex challenges faced by business and Governments around the world.

As you can see, Gilbert has held prestigious positions at companies like Ernst & Young, HSBC, BP Oil, Vocalink and Price Waterhouse Coopers.

If that was not impressive enough, his public sector experience includes working with UK Treasury, the UK Ministry of Justice, the Bank of England, and the Federal Reserve. In 2015, Gilbert helped found the Blockchain ISO Standard TC307 which is now used by almost 60 countries around the world to guide their blockchain development.

Gilbert Verdian is also chairman for Blockchain and Distributed Ledger Technology for the BIS.

Some examples of organizations who are part of this committee include:

Quant

IBM

Microsoft

HSBC

BAE Systems

Sony Europe

Charted Association of Certified Accountants

MIT Connection Science

UK Government

International Association for Trusted Blockchain Applications (INATBA)

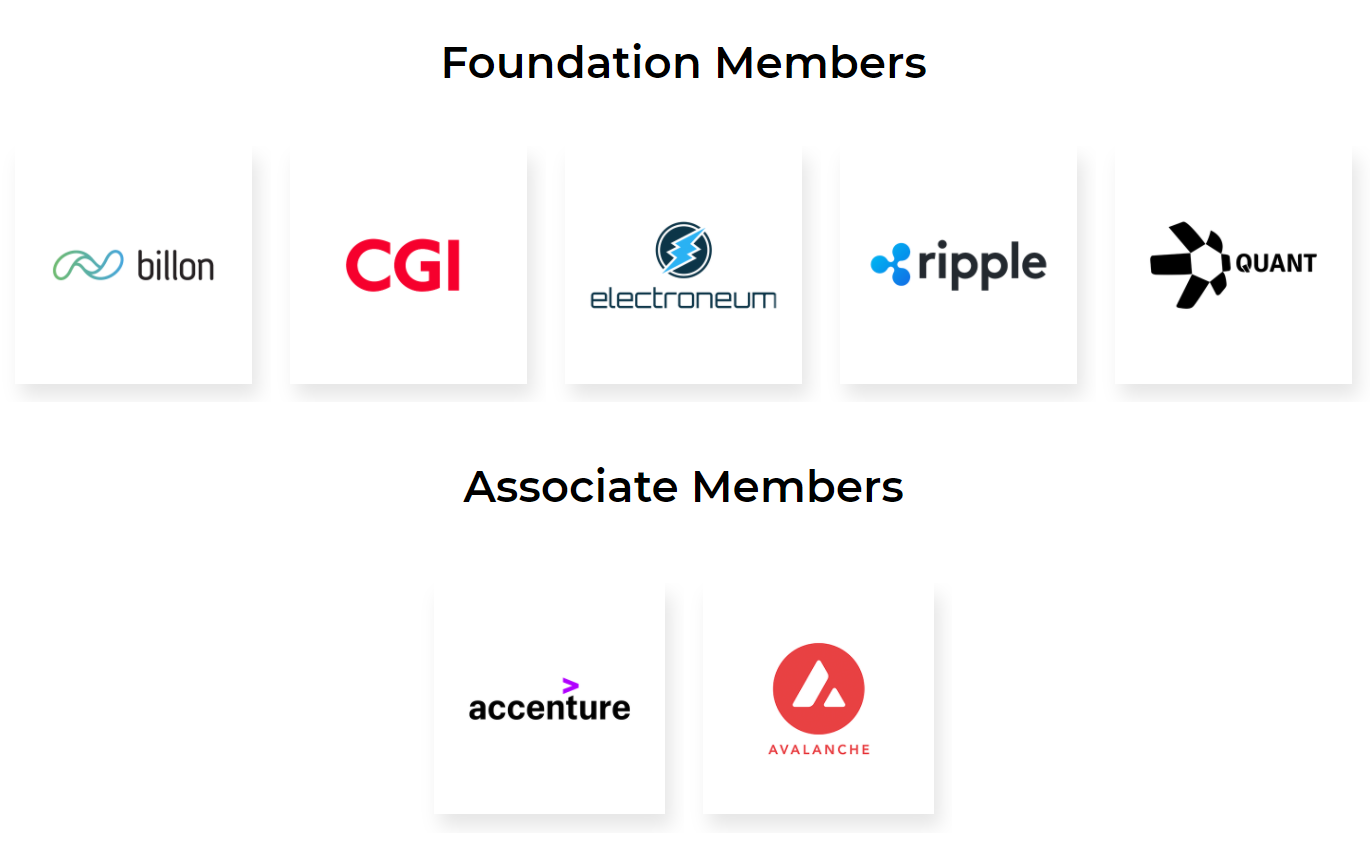

Quant Network is a founding member in the European Union’s launch of the International Association for Trusted Blockchain Applications (INATBA).

In 2019, Gilbert Verdian was selected as an official signatory at the event. Other members of INATBA include Accenture, Accord Project, Alastria, Banco Santander, BBVA, Consensys, Enterprise Ethereum Alliance, Fujitsu, IOTA, Ledger, SAP, SIA, Swift, Telefonica, We.Trade and many more.

The INATBA is an initiative promoted by the EU’s European Blockchain Partnership — a collaboration of 26 EU countries as well as Norway, including UK, France, Germany, Sweden, the Netherlands, and Ireland. Its objective is to develop EU blockchain regulation and prepare for the launch of EU-wide blockchain applications.

Quant Network has been a pioneer in setting the blockchain agenda for Governments by helping implement and foster mass adoption of distributed ledger technology. Firstly, by founding the Blockchain ISO Standard TC307 in 2015. Then collaborating with EU countries through INATBA.

Digital Pound Foundation

Quant, along with Ripple, are founding members of the Digital Pound Foundation.

“We are very excited to be part of the launch of the Digital Pound Foundation. Today, this is an important milestone for the UK. We have already got the most advanced payment system in the world, and having a digital pound allows us to innovate further and to increase competition, openness and the exportability of a digital pound across the world in various use cases.”

“Why is this important for us? So at Quant, we are innovators in DLT and blockchain technology. We are constantly creating standards. We have solved interoperability, and this is a great way to be involved to help make cross-border use cases and new innovation and new payment types and flows for businesses and consumers.”

-Gilbert Verdian, CEO at Quant

Quant’s Major Partnerships

Major partnerships including SIAnet and SIAchain which are existing financial infrastructures already in use and interconnected to 570 banks and financial institutions. These banks and institutions now have access to Overledger.

Quant is also providing interoperability for LACChain, the regional blockchain network for Latin America, backed by the Inter-American Development Bank. Quant aims to work with banks to enable cross border payments as well as work on retail focused CBDC for the Latin American Dollar.

Quant has also been named as a supplier for the UK Government Crown Commercial Services and have partnered with AUCloud who work with the Australian Government and Department of Defense, validating Quant’s technology for being incredibly secure and compliant by being able to operate in the most sensitive of networks.

Oracle

Oracle invited Quant to attend the leading financial event of the year — SWIFT SIBOS where Oracle was co-marketing with Quant to take their solution to their 480,000 clients including meetings with Banks / Central Banks. Every top bank in the world uses Oracle and Quant has been selected as one of their three Fintech Partner companies.

Liechtenstein Crypto assets Exchange : LCX

Quant partnered with Liechtenstein Blockchain Innovator, LCX, to accelerate the progression towards Central Bank Digital Currencies (CBDCs). Liechtenstein Crypto assets Exchange is a regulated fintech company that focuses on digital asset trading, compliant token offerings and tokenization.

“We do share the same vision of building a bridge between the traditional financial markets and future blockchain based monetary systems. Quant has built the foundational technology solution for DLT interoperability which is important for the growth of LCX and the industry as a whole”

-Monty C. M. Metzger, CEO of LCX

AllianceBlock : ABLT

Quant Network partnered with AllianceBlock — an AI-powered decentralized investment and financing ecosystem, which allows corporates to quickly, cheaply and safely raise funds, whether it be equity, debt or tokens.

“AllianceBlock will use Overledger to leverage multiple blockchains and create multi-chains token swaps. This partnership offers the possibility to open a new set of real-world applications leveraging different features from different chains. AllianceBlock is delighted about this partnership which will help blockchain projects and SMEs wield blockchain technology very easily”

- Rachid Ajaja, Co-founder of AllianceBlock.

Constellation : DAG

Constellation and Quant will provide robust security for IoT (internet of things) and interoperability of data between systems and devices for use cases like smart cities.

“The third generation of blockchain technologies includes plug-in-play interfaces with functional operating systems, like the Quant Network, and robust developer solutions that meet the existing needs of data science.

With nearly 28 billion devices coming online by 2022, that’s nearly 4 devices for every person that produces 1.7megs of data every second. The Quant and Constellation partnership introduces an end-to-end development ecosystem that accommodates a world of big data”-Benjamin Jorgensen, CEO, and Co-Founder of Constellation Network

Quant’s Value

Metcalfe’s Law states that a network’s value is proportional to the square of the number of its users. This network of “networks effects” will cause not only the ecosystem to grow exponentially but also the value of the network as more and more join the ecosystem. These network effects lead to explosive growth as seen with the Internet and other social media platforms.

Quant has a very small supply of just 14.6 Million QNT. That is 2/3 the total supply of Bitcoin. No new tokens will ever be minted and there is no inflation. The team only holds a small percentage of tokens compared to most projects.

As tokens are locked up through annual licenses, payment channels and gateway staking, the circulating supply of QNT will reduce overtime, creating deflationary pressure which will lead to price increases.

Unlike most projects, the token is needed by everyone, including enterprises, banks and governments. The Quant Treasury facilitates enterprises to pay in FIAT which then gets converted to QNT rather than enterprises themselves having to purchase from exchanges directly.

As the world moves into the digital age, Quant Network stands out as a crucial component for interoperability between the legacy financial world and distributed ledger technology (DLT)/blockchain world. Central Bank Digital Currencies are here and we are on the verge of tokenization of all assets (stocks, bonds, real estate). Quant provides the operating system to connect it all.

QNT is currently trading at $280 after hitting an all time high of $384. If Quant reaches the current Market Cap of DOGE $35billion, QNT would be worth $3000.